Economic performance and outlook

OPEC+ extends cuts

In December OPEC+ decided to significantly slow down its tapering of voluntary production cuts and extend broader production quotas for another year, until the end of 2026.1 This action to support prices was taken amidst weaker demand growth than OPEC had forecast (notably in China, where EV sales surged, and oil imports fell for the first year in decades). If this plan is followed, OPEC+ will have managed the group’s production for at least a decade, a remarkable track record of cooperation that has significantly shaped the oil market and the Middle East’s economy.

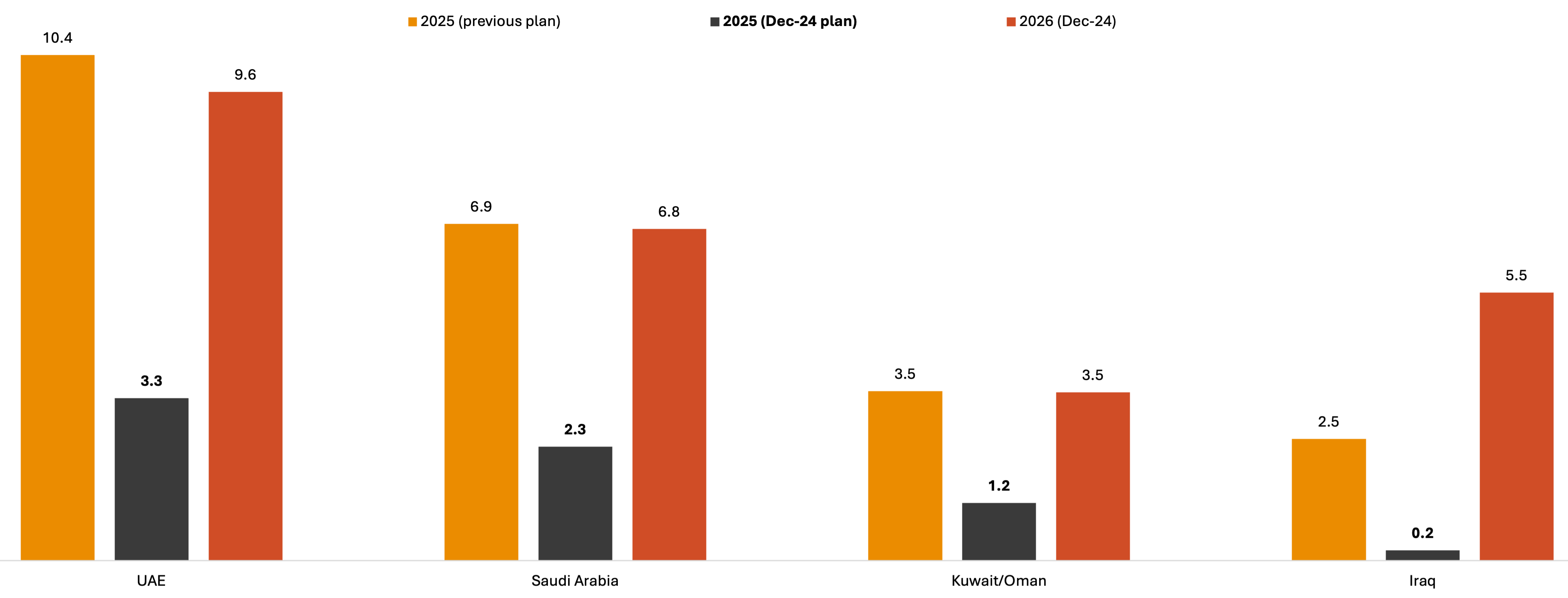

For most Middle Eastern states, the growth in their allocated production in 2025 will be about a third of what had been planned for 2025, ranging from 3.3% growth for the UAE down to just 1.2% for Kuwait and Oman. Iraq’s production is anticipated to be nearly flat because it is expected to be making additional cuts of around 0.1m b/d to compensate for past overproduction (mainly related to the federal government’s insufficient control over production in the Kurdistan region).2 Bahrain has not participated in voluntary cuts and so its production quota remains fixed at the November 2022 level of 196k b/d, which it has rarely achieved in recent years.

Trends in OPEC+ production allocations for Middle Eastern states (% y/y)

Source: OPEC

The new rules mean that the 2.2m b/d in voluntary cuts initiated in January 2024 by eight mainly Arab countries, which was originally planned to be lifted in September 2024, will remain in place through the first quarter of 2025 and will then phase back gradually over 18 months. The overall impact of these changes is that OPEC+ will expand production in 2025 by only 0.5m b/d on average, a third of the previous plan, followed by 1.5m b/d on average in 2026.

Even these more gradual adjustments may be difficult for the oil market to absorb because they are still greater than the difference between expected demand growth and growth in non-OPEC+ supply. Even OPEC itself only sees this gap, referred to as the “call” on OPEC+, growing by about 0.2m b/d in both 2025 and 20263, whereas the IEA sees non-OPEC+ supply growth outstripping demand.4 Aside from the demand pressures, some OPEC+ members are unhappy with their quotas, particularly those such as UAE, Iraq and Kazakhstan that have been investing to grow their production capacity—such investments will not see a return if production is constrained indefinitely. It therefore remains to be seen whether OPEC+ will stick with the current plan throughout this year, further tighten controls or be forced to loosen them.

A new pressure has emerged with the inauguration of President Trump, who demanded that OPEC act to lower prices. All these factors create considerable uncertainty for the trajectory of oil prices in 2025, although most forecasters see an average from Brent crude in the low US$70s, down from US$80 in 2024.

Non-oil sectors remain robust

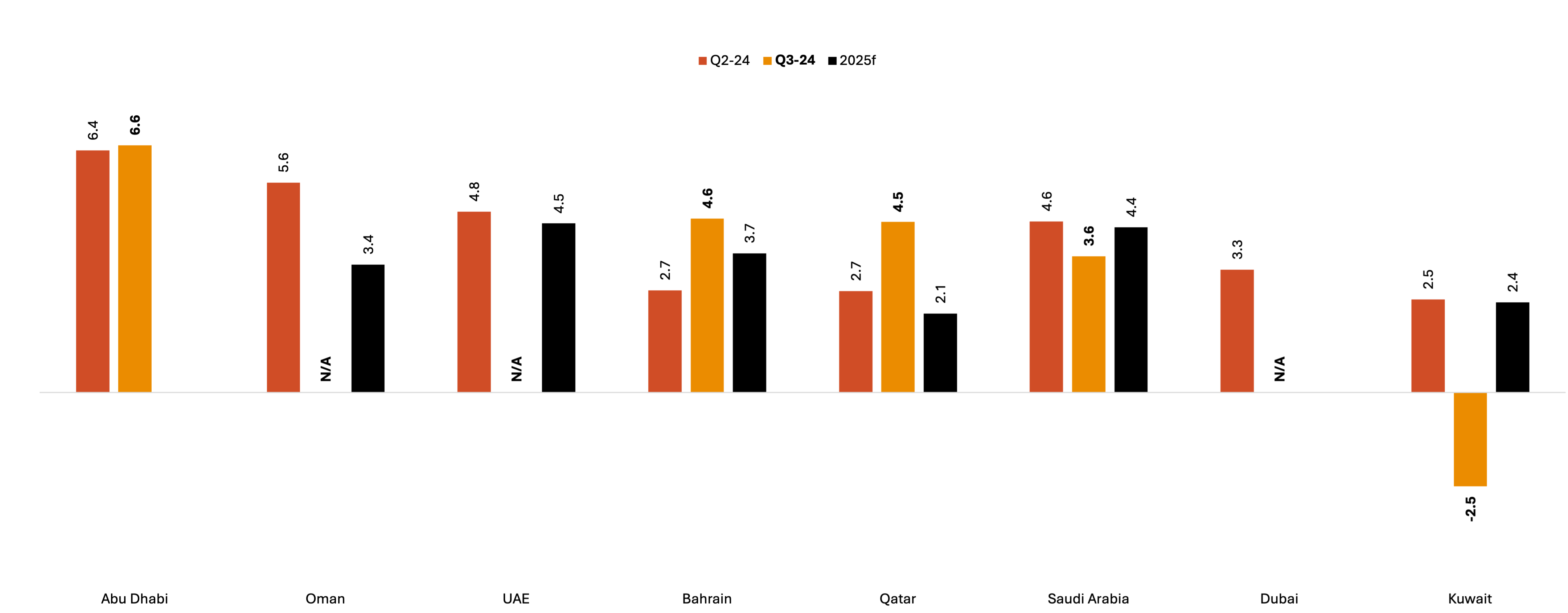

The most recent data points to robust non-oil growth across most of the GCC, with expectations that this will continue in 2025. The strongest growth in the region in Q3 2024 came from Abu Dhabi at 6.6% y/y, the strongest in the year, which was broad-based but led by financial services (11.6%) - and the continued expansion of Abu Dhabi Global Market, which was on display at the annual finance week in December, and transportation (18%). Other GCC economies that have reported results showed reasonable growth, except for Kuwait, which recorded a -2.5% y/y decline, mainly due to a -10.8% decline in manufacturing (a sector that has been volatile in recent years). Kuwait’s PMI did see a dip in Q3, although only to 50.5, which should not indicate a contraction, but then rebounded strongly to a quarterly record of 54.2 in Q4, which might point to a similar rebound in non-oil GDP.

Non-oil GDP growth (% y/y, real)

Sources: National statistical agencies, IMF forecasts; N.B. “non-oil” is standardised here as total GDP at constant market prices minus upstream oil.

PMI data suggests strong momentum going into Q1 2025, especially Saudi Arabia, which rose to 60.5, the highest in over a decade. The IMF forecasts non-oil growth ranging from 2.1% for Qatar to 4.4% for Saudi Arabia and 4.5% for the UAE.

A weaker oil sector outlook may affect GCC government spending, impacting the non-oil sector. Despite this, most states are projected to achieve fiscal surpluses. Saudi Arabia, facing a third consecutive deficit, is expected to easily finance it through debt capital markets. This was demonstrated when it started the year by selling $12bn in bonds, matching its previous record on strong order levels and covering a third of the funding estimated in its annual borrowing plan.5 Therefore, except for Bahrain, which has yet to finalise its 2025 budget, public spending is not likely to be a significant constraint on growth.

References

1) OPEC, 5 December 2024, Saudi Arabia, Russia, Iraq, United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman held a virtual meeting on the sidelines of the 38th OPEC and non-OPEC Ministerial Meeting

2) OPEC, 22 August 2024, OPEC Secretariat receives updated compensation plans from Iraq and Kazakhstan

3) OPEC, 15 January 2025, Oil Market Report

4) IEA, 15 January 2025, Oil Market Report

5) Bloomberg, 6 January 2025, Saudi Arabia Starts 2025 With a $12 Billion Bond and PIF Loan

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100