GCC economies are broadening their tax bases

GCC economies are expanding their tax bases to diversify non-oil revenue, enhance fiscal sustainability and respond to international tax developments such as the new global minimum tax for large multinational enterprises. In recent years, GCC countries have introduced a range of tax reforms, such as the introduction of value-added tax (VAT), excise duties, real estate transfer taxes and more recently broad-based corporate income taxes.

Non-oil tax revenues in 2023 ranged from 1% of GDP in Kuwait16 to 9% in Saudi Arabia.17 Although Kuwait and Qatar have yet to introduce VAT and despite VAT rates in the other GCC countries being low by international standards, most of the non-oil tax revenue in the GCC comes from taxes on the import and consumption of goods and services. This is in part due to the absence of personal income taxes in the GCC and some of the GCC countries having limited corporate tax regimes that only apply to foreign-owned businesses and the hydrocarbon sector.

In its latest report on the Gulf region, the IMF suggested that GCC countries should continue reforming their tax regimes to mobilise additional tax revenue, and to reduce complexity to improve tax collection.

In addition to revenue generation and diversification, GCC countries are also introducing new taxes to improve transparency and promote responsible corporate practices through additional reporting and disclosures. Data collected from taxpayers and the tax administration can offer policymakers valuable insights into trends related to economic activity, consumption, employment and profitability.

Moreover, taxes have long been used to promote or discourage certain behaviours and achieve social and economic objectives, and this is increasingly being witnessed in the GCC as well. For example, most GCC countries have introduced excise taxes on unhealthy products, the UAE corporate tax regime has various sector-specific incentives and exemptions, and white land taxes in Saudi Arabia were introduced to incentivise urban land development. GCC countries are also exploring potential carbon taxes and tax incentives to encourage sustainable investments and business activity.

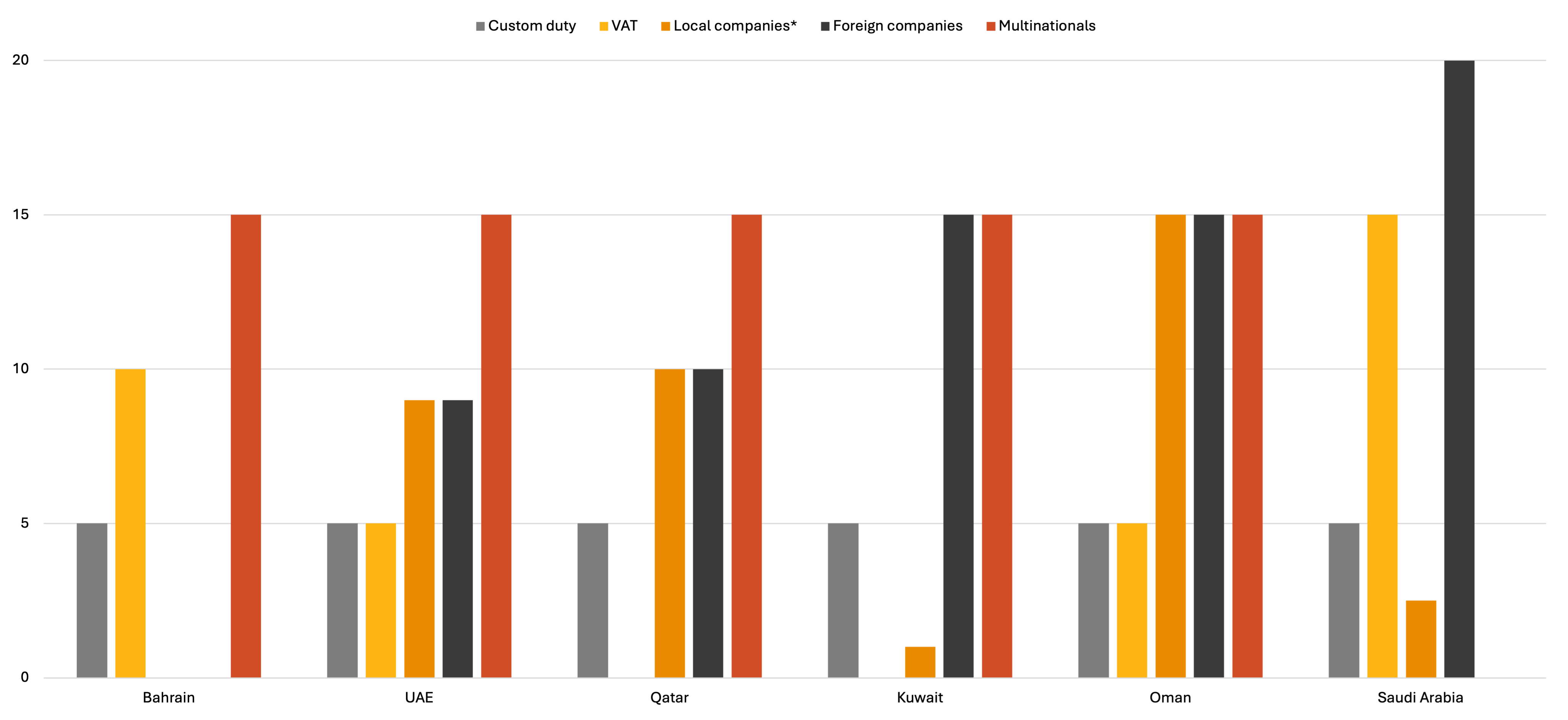

Main Tax Rates (%)

Source: Tax authorities; * Kuwait taxes listed companies at 1% Zakat on net profits in addition to National Labor Support Tax and a Contribution to Kuwait Foundation for Advancement of Sciences. Saudi Arabia charges GCC owned companies 2.5% Zakat

Taxing large multinationals

A significant development in the global harmonisation of tax regulations is the implementation of the Global Anti-Base Erosion (GloBE) rules. This global tax framework, also referred to as “Pillar Two”, was introduced by the OECD/G20 Inclusive Framework on BEPS to ensure that large multinational enterprises (MNEs) pay an effective corporate tax rate of at least 15% in each jurisdiction where they operate.

All of the GCC countries are members of the Inclusive Framework18 and, apart from Saudi Arabia, have taken steps to implement the GloBE rules starting 2025. Bahrain was the first to issue its Pillar Two legislation in September 2024,19 and other GCC countries followed in quick succession. As a result, MNEs with global revenues over €750m that are headquartered or operating in the GCC will be subject to a minimum 15% corporate tax rate in Bahrain, Kuwait, Oman, Qatar and the UAE from 1 January 2025. Saudi Arabia has yet to announce its plans to implement the GloBE rules in the Kingdom.

The additional tax revenue the GloBE rules might raise in the GCC will vary significantly from country to country and will depend on many factors such as the effective tax burden under the existing corporate tax rules of the country, the number and profitability of the companies that will be subject to the GloBE rules, and how each GCC country decides to implement the GloBE rules.

As the only GCC country without a comprehensive corporate tax regime, Bahrain may generate the most significant tax revenue gains from the application of a Domestic Minimum Top-up Tax (DMTT) to large MNEs headquartered and operating in the Kingdom. The UAE introduced a broad-based corporate tax regime in 2023 with a headline rate of 9%, but given the large number of UAE-headquartered MNEs and foreign MNE groups with operations in the UAE, it may also collect significant additional tax revenues under the DMTT regime that was announced in December 2024.

In Kuwait, media reports indicate that the recently announced DMTT could generate additional tax revenues of about KD250m (c.US$162m) from predominantly 20 Kuwaiti MNEs,20 which is equivalent to c.0.5% of GDP and about half of the existing tax revenue collected from foreign companies that are subject to 15% corporate tax.

Oman already levies a 15% corporate tax on most businesses, but the implementation of a Pillar Two top-up tax through the Income Inclusion Rule may generate additional tax revenues for the Sultanate on profits generated outside of Oman by Omani headquartered MNEs or MNE group entities in Oman that hold foreign operations.

In Saudi Arabia, the adoption of the GloBE rules may not have a significant financial impact on foreign MNE groups which are already paying 20% corporate tax. However, Saudi headquartered groups that are currently subject to Zakat at 2.5% may face a significant change in their effective tax burden.

Taxing local companies and individuals

Following the introduction of a broad-based corporate tax regime in the UAE, there has been talk about Bahrain21, Kuwait22 and the Kingdom of Saudi Arabia potentially reforming their existing corporate tax regimes. It is unclear at the moment if or when any such reforms may take place or become effective.

Other than Oman, none of the GCC countries have indicated the intention to introduce personal income taxes. The plan to introduce a personal income tax in Oman on ‘high-earners’ has been postponed until an undefined future date.

The tax landscape in the GCC has transformed dramatically since 2017. While it is difficult to predict what further changes are ahead, it seems clear that the modernisation of taxes in the region will continue to play an important role, not only to diversify revenue sources, but also to support public policy.

References

16) Kuwait Ministry of Finance Budget statement 2023-2024

17) Saudi Arabia Ministry of Finance 2023 Financial Report

18) OECD, 28 May 2024, Members of the OECD/G20 Inclusive Framework on BEPS

19) PwC Middle East, 17 September 2024, Bahrain Domestic Minimum Top-up Tax for Multinational Enterprises

20) Kuwait Times, 6 January 2025, New 15% tax to impact 20 Kuwaiti and 350 foreign entities

21) News of Bahrain, 20 June 2024, Lawmakers Propose New Bill to Implement Corporate Income Tax

22) Arab Times, 7 December 2024, Kuwait proposes 15% business tax with exemptions for small companies

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100