January 2026

Global M&A trends in energy, utilities, and resources: 2026 outlook

The energy, utilities and resources sectors are experiencing structural change as digital infrastructure, electrification and the energy transition reshape global markets. Current energy M&A and utilities deal trends reflect a strategic shift towards resilience, portfolio repositioning and long‑term value creation. Discover how targeted energy transition investment is shaping competitive advantage across the energy value chain.

September 2025

The changing energy order

Global energy demand continues to grow and, along with it, the urgency of understanding the local, country-by-country dynamics of the energy transition.

2025

Indonesia energy, utilities and resources statement of capabilities

Delivering value with industry-focused services

Our Indonesian Energy, Utilities & Resources (EU&R) practice comprises over 400 professionals across our lines of service - Assurance, Tax Services, Advisory, Consulting and Legal Services. This large group of professionals has deep industry knowledge providing us with the largest group of industry specialists in the Indonesian professional market. At PwC, we help our clients solve complex business problems by combining a global mindset and local resources with positive actions. Through our involvement with the Indonesian Petroleum Association (IPA), the Indonesian Mining Association (IMA), the Indonesian Coal Mining Association (ICMA), Indonesian Independent Power Producer Association and other industry bodies we are helping to shape the industry as it progresses towards truly world-class standards.

June 2024

Global M&A trends in energy, utilities and resources: 2024 mid-year outlook

Velocity of energy transition and industrial reconfiguration create an exciting arena for M&A in energy, utilities and resources.

2024

Fulfilling the potential of green hydrogen

Explore the role of clean hydrogen in decarbonising hard-to-abate sectors as well as barriers to clean hydrogen development and adoption.

2024

Tapping into the power of blended finance

Accelerating progress in Asia-Pacific’s energy transition presents an enormous opportunity to marshal the powerful combined forces of public and private capital.

2024

2024 Outlook

Global M&A Trends in Energy, Utilities and Resources

Energy, utilities and resources sectors will be a bright spot for M&A activity in 2024 as the energy transition continues to attract investor interest.

2017

Financial reporting in the oil and gas industry

International Financial Reporting Standards – 3rd edition

This publication examines the accounting issues that are most significant for the oil and gas industry. The issues are addressed following the oil and gas value chain: exploration and development, production and sales of product, together with issues that are pervasive to a typical oil and gas entity.

2012

Financial reporting in the mining industry

International Financial Reporting Standards – 6th edition

May 2025

Oil and Gas in Indonesia: Investment, taxation and regulatory guide - 14th Edition

The 14th edition of the guide provides updates on recent tax, regulatory, and commercial changes, focusing on Indonesia's energy transition. It explores the evolving global energy landscape, policy frameworks, and the integration of renewable energy sources like solar and wind into existing oil and gas infrastructure. The guide emphasises the importance of energy efficiency in reducing carbon emissions and highlights the development of Carbon Capture and Storage (CCS) technologies as a promising solution for mitigating emissions from fossil fuel industries, contributing to global climate change efforts.

May 2024

Oil and Gas in Indonesia: Investment, taxation and regulatory guide - 13th Edition

In recent years, we have witnessed a rapid transformation in the macroeconomic landscape, with sustainability taking centre-stage. However, this shift in focus presents a challenge, as many countries still heavily rely on fossil fuels for their energy needs and daily necessities, including petrochemical products. Recognising the need to balance sustainability with energy and petrochemical product demand, the investment climate for oil and gas has become even more crucial. In response, the Indonesian government has implemented alternative solutions, such as the establishment of a carbon credit market to promote emission offsetting. Additionally, there is a growing emphasis on carbon capture & storage (CCS) as a prominent solution, given Indonesia’s immense potential in this area. These initiatives align with the government’s broader focus on energy transition, aiming to strike a balance between energy demand and economic growth, and the country’s commitment to achieving net-zero emissions by 2060.

This edition of the guide focuses on updating readers on the latest tax, regulatory and commercial changes since our previous edition, with a deep dive into the energy transition in Indonesia.

May 2025

Indonesian Oil and Gas Concessions and Major Infrastructure Map

PwC Indonesia recently released its updated Indonesian Oil and Gas Concessions and Infrastructure Map.

The map provides information on 267 oil and gas blocks by operator (including Government blocks); the operator name, location, block name and contract type. Additional information on major oil and gas infrastructure across Indonesia is also presented on the map.

Please fill out the form here to obtain a hard copy of the map.

July 2023

Oil and Gas in Indonesia: Investment and Taxation Guide 2023 - 12th Edition

Over the past three years, the COVID-19 pandemic and geopolitical instability from the Russia-Ukraine conflict, energy supply disruption and price volatility resulted in an unpredictable macroeconomic situation. The uncertainty has highlighted the "energy trilemma", with the competing interests of energy supply, affordability and environmental sustainability causing energy companies and governments across the world to re-think their net zero strategies. This edition of the guide focuses on updating readers on the latest tax, regulatory and commercial changes since our previous edition, with a brief update on the energy transition in Indonesia.

February 2021

Oil and Gas in Indonesia: Investment and Taxation Guide 2020 - 11th Edition

As we write, the world still finds itself in the midst of the COVID-19 pandemic, and so we have decided not to do a full update of our Guide, but rather to focus only on the latest tax and regulatory changes that have occurred from when we issued our last Guide in the last quarter of 2019 up to the end of the third quarter of 2020. The updates have been provided in the form of a summary of changes presented at the beginning of each section. The impact of the COVID-19 pandemic and uncertainty in the macroeconomic situation are the biggest concerns for stakeholders in the oil and gas industry in Indonesia similar to their counterparts around the world. We have attempted to summarise the changes in key regulations the Government of Indonesia has issued as a response in these uncertain times.

2020

2020 Digital Operation Study for Energy - Oil and Gas

Even before the outbreak of the COVID-19 pandemic, the energy industry had been undergoing profound technological disruption. The “fracking revolution”, the rise of renewable energy, improvements in battery storage, a strong push for a hydrogen economy and the electrification of transport represent opportunities for transformation as well as a fundamental competitive threat. These new technologies – combined with digitization – can bring new skill sets and cost efficiencies to the energy, utilities and resources (EU&R) sector, even before they open the door to new competitors. Seen in this context, COVID-19 represents one more challenge in the complex set of issues the EU&R sector has already been grappling with.

2020

Drilling for Data - a Pragmatic Perspective on Demystifying Digitization in Oil and Gas

The oil and gas sector is making significant strides in digitization. After a few years of carrying out small-scale pilots, a number of oil companies are now leading the way. They have recruited chief digital officers, have designed digital strategies and established business units to promote them, have partnered with technology firms, and are striving to create a culture that nurtures new ways of working. We are witnessing a proliferation of technologies being deployed in the field, whether it’s the use of so-called digital twins to optimize production or drones carrying out offshore inspections.

September 2019

Oil and Gas in Indonesia: Investment and Taxation Guide 2019 - 10th Edition

This 10th edition of the PwC Indonesia "Oil and Gas in Indonesia - Investment and Taxation Guide" released in September 2019 outlines the latest tax and regulatory changes that have occurred in the oil and gas industry over recent years, including our views on recent regulatory developments surrounding the new “Gross Split” PSCs.

May 2018

Oil and Gas in Indonesia: Investment and Taxation Guide 2018 - 9th Edition

This 9th edition of the PwC Indonesia "Oil and Gas in Indonesia - Investment and Taxation Guide" released in May 2018 captures the latest tax and regulatory updates that have occurred in the oil and gas industry over the past year, including our early views on the new "Gross Split" PSCs.

The development of the oil and gas industry in Indonesia has been successful in many areas, including the pioneering of the Production Sharing Contract (PSC) model and the commercialisation of Liquefied Natural Gas (LNG). However, oil production has waned over recent years, with Indonesia's production and opportunity profile moving steadily away from oil and towards gas - a trend which is likely to continue.

May 2017

Oil and Gas in Indonesia ─ Investment & Taxation Guide

Investment and Taxation Guide ─ 8th edition

The eighth edition of PwC Indonesia Oil and Gas in Indonesia ─ Investment and Taxation Guide 2017 captures the latest tax and regulatory changes that have occurred in the oil and gas industry during the past two years. Oil and gas production has a long and relatively successful history in Indonesia, with the sector historically characterized by its relatively stable and well-understood regulatory framework. In many years, including the development of the Production Sharing Contract (PSC) model and the commercialization of Liquefied Natural Gas (LNG), Indonesia has been an international pioneer.

May 2016

Oil and Gas in Indonesia

Investment and Taxation Guide – 7th edition

The 7th edition captures the latest tax and regulatory changes that have occurred in the oil and gas industry during the past two years.

The industry is arguably now in a transitional phase, with a growing domestic need for gas (both for consumers and industrial use), the commencement of LNG imports and the construction of further LNG regasification units - all amid chronically low crude oil prices. Indonesia’s production and opportunity profile has also moved steadily away from oil and towards gas - a trend which may ultimately represent a permanent shift. In short, the age of relative stability in this sector has probably passed. The pace of change is likely only to accelerate. It is hoped that this guide will provide readers with the information necessary to better understand these dynamics.

May 2016

Is the drum half full or half empty?

An investor survey of the Indonesian oil and gas industry - 8th edition

This is the eighth edition of our survey of the Indonesian oil and gas industry. The purpose of the survey is to help inform the public and private sectors about Indonesia’s petroleum industry and to highlight some of the challenges in attracting optimal investment and achieving its full potential. Where possible, we have compared current results with the results from prior surveys to highlight trends and to assess whether conditions are deteriorating or improving.

February 2016

New Energy Futures: Perspectives on the transformation of oil and gas sector

Global demand for affordable, reliable energy will continue to grow for the foreseeable future, but there is a new longer-term backdrop as the world transitions to a low carbon system. Companies in the oil and gas sector need to reconsider their portfolio and related capabilities to not only survive, but thrive, in this new future.

May 2015

Challenges for a new era

An investor survey of the Indonesian oil and gas industry – May 2015

This is the seventh edition of our survey of the Indonesian oil and gas industry, and where applicable we have analyzed the collective trends in survey participants’ responses using the current and prior reports. The survey responses come from 95 respondents from 75 different companies currently operating in the Indonesian oil and gas sector and therefore can be used to draw credible conclusions about the issues preventing the industry from reaching its full potential.

Opportunities, Risks, Rewards – a balancing act

An investor survey of the Indonesian oil and gas industry – May 2014

May 2014

Oil and Gas in Indonesia

Investment and Taxation Guide – 6th edition

The 6th edition captures the latest tax and regulatory changes that have occurred in the oil and gas industry during the past two years. In particular, this edition covers the most recent developments related to GR 79, land and building tax and the new negative investment list. This publication has been written as a general investment and taxation tool for all stakeholders and those interested in the oil and gas sector in Indonesia. We have therefore endeavoured to create a publication which can be of use to existing investors, potential investors, and others who might have a more casual interest in the status of this important sector in Indonesia.

As outlined on the contents page, this publication is broken into chapters which cover the following broad topics:

- an industry overview

- the regulatory framework

- the upstream sector

- the downstream sector

- oilfield service providers

- unconventional gas

July 2025

Mine 2025: Concentrating on the future

The mining industry continues to expand its horizons as it provides the vital materials that support fundamental human needs.

January 2025

Mining in Indonesia: Investment, Taxation and Regulatory Guide ─ 14th edition

This fourteenth edition of the guide aims to help investors navigate the Indonesian mining investment landscape, drive industry growth, and support sustainability and energy transition efforts. Reflecting regulations issued up to 31 December 2024, this publication focuses on the latest tax, regulatory, and commercial changes since our previous edition.

January 2025

Indonesian Mining Areas Map

PwC Indonesia recently released its updated map of Indonesia’s Mining Areas. The map provides details of key coal and minerals mining operations in Indonesia and the location of key mining infrastructure such as ports and coal-fired power plants.

Please fill out the form here to obtain our latest Indonesian Mining Areas Map.

June 2024

Mine 2024: Preparing for impact

PwC’s 21st Mine report focuses on how the industry is planning for impact—retooling and reimagining itself to be a key contributor to sustainable growth.

September 2023

Mining in Indonesia: Investment, Taxation and Regulatory Guide 2023 ─ 13th edition

This edition of the guide focuses on updating readers on the latest tax, regulatory and commercial changes since our previous edition. This publication has been written as a general investment and taxation guide for all stakeholders interested in the mining sector in Indonesia. We have therefore endeavoured to create a publication which can be of use to existing investors, potential investors, and others who might have a general interest in the status of this important sector for the Indonesian economy.

June 2023

Mine 2023: The era of reinvention

PwC’s 20th Global Mine Report analyses an industry in transition. Critical minerals have become central to the development of low-emission energy systems, and miners must adapt if they want to help achieve economic prosperity and a low-carbon future.

September 2022

Mining in Indonesia: Investment and Taxation Guide 2022 ─ 12th edition

Welcome to the twelfth edition of PwC Indonesia’s Mining in Indonesia: Investment and Taxation Guide.

The race to net zero is changing what it means to be a miner. Demand for critical minerals is surging and operating environments are getting more challenging. The market for mining materials is reconfiguring in fundamental ways. The energy transition and the race to reach net-zero emissions are creating a surge in demand for ‘critical minerals’.

June 2022

Mine 2022: A critical transition

New PwC report on global mining explores whether or not the Top 40 mining companies can prioritise ESG and take a leading role in the world’s clean energy transition.

June 2021

Mine 2021: Great expectations, seizing tomorrow

The Top 40 mining companies have come out of the storms of 2020 in excellent financial shape.

Mining is one of the few industries that emerged from the worst of the COVID-19 pandemic economic crisis in excellent financial and operational shape. In fact, 2020 was a banner year for the mining sector. And things are expected to get even better for the world’s biggest mining companies.

June 2020

Mine 2020: Resilient and Resourceful

Welcome to PwC’s 17th annual review of global trends in the mining industry – Mine. Our outlook indicates the Top 40 mining companies are so far weathering the COVID-19 storm mostly unscathed, but global growth is expected to decline in 2020.

June 2019

Mining in Indonesia: Investment and Taxation Guide 2019 ─ 11th edition

Welcome to the eleventh edition of PwC Indonesia’s Mining in Indonesia: Investment and Taxation Guide.

Since the Law on Mineral and Coal Mining No. 4 of 2009 (the “Mining Law”) was

promulgated, various implementing regulations, including a number of amendments, havebeen issued by the Government in pursuing the goals of the Mining Law. Many challenges however still remain.

June 2019

Mine 2019: Resourcing the future

Welcome to PwC’s 16th annual review of global trends in the mining industry – Mine. This analysis is based on the financial performance and position of the global mining industry as represented by the Top 40 mining companies by market capitalisation.

June 2018

Mine 2018: Tempting times

Our 2018 outlook indicates that the Top 40's improved financial performance will continue as companies continue to benefit from this upward momentum in the mining cycle.

May 2018

Mining in Indonesia: Investment and Taxation Guide 2018 ─ 10th edition

We welcome you to the 10th edition of the PwC Indonesia "Mining in Indonesia: Investment and Taxation Guide" released in May 2018, which highlights the key regulatory and taxation considerations for investors in the Indonesian mining sector - a sector which continues to be a key contributor to Indonesian economic growth.

Since the new Mining Law was introduced in 2009 various implementing regulations, and subsequent amendments, have been issued by the Government in pursuing the goals of the Mining Law. In 2018 the Government has sought to reduce the overall bureaucracy by simplifying current regulations with an aim of attracting more investment.

June 2017

Mine 2017: Stop. Think...Act

PwC's 14th annual review of global trends in the mining industry is based on the financial performance and position of the global mining industry as represented by the top 40 global mining companies by market capitalisation.

2016 was a year of recovery for the world’s largest Top 40 mining companies, with profitability returning and balance sheet repair well underway.

May 2017

Mining in Indonesia

Investment and Taxation Guide - 9th edition

Our guide has been written as a general investment and taxation tool for all stakeholders and those interested in the mining sector in Indonesia. We have therefore endeavoured to create a publication which can be of use to existing investors, potential investors, and others who might have an interest in the status of this important sector in Indonesia.

March 2017

We need to talk - About the future of mining

What can mining executives do today to prepare for such an uncertain tomorrow? What strategic decisions need to be thought through and made now, to ensure your company will be thriving 5, 10 or 20 years down the track?

June 2016

Mine 2016: Slower, lower, weaker... but not defeated

Review of global trends in the mining industry

2015 was a race to the bottom with many new records set by the world’s 40 largest mining companies according to the PwC’s annual Mine report.

The 13th in PwC’s industry series analysing financial performance and global trends, the report reveals a first ever collective net loss (US$27bn) for the top 40 miners with market capitalisation falling by £297bn (37%), effectively wiping out all the gains made during the commodity super cycle.

May 2016

Mining in Indonesia

Investment and Taxation Guide - 8th edition

It is now more than seven years since the 2009 Law on Mineral and Coal Mining No. 4 of 2009 (the “Mining Law”) was promulgated. While various implementing regulations, including a number of amendments, have been issued by the Government in pursuing the goals of the Mining Law, there remain many challenges for investors, particularly in the current low commodity price environment.

May 2015

Mining in Indonesia

Investment and Taxation Guide - 7th edition

It is now six years since the 2009 Law on Mineral and Coal Mining No.4 of 2009 (the "Mining Law") was promulgated, with the aim of maximising the benefits of the coal and minerals sectors for Indonesia. Various key implementing regulations, including related amendments, have been issued by the Government over the past five years to ensure that the ultimate goals of the Mining Law can be realised. However, over this period, stakeholders in the Indonesian mining industry have experienced various challenges in understanding and implementing the Mining Law and associated regulations.

December 2014 and 2013

PT Mining Indonesia Tbk

Illustrative Consolidated Financial Statements – 31 December 2014 and 2013

December 2025

Power in Indonesia: Investment, taxation and regulatory guide - 8th edition

Our eighth edition of the guide provides strategic insights into energy transition, renewable energy investment opportunities, taxation frameworks and regulatory updates as of 31 October 2025. Intended for investors and industry leaders, it highlights key reforms, market dynamics and practical considerations to help you capitalise on Indonesia’s drive towards sustainability and net-zero emissions.

August 2023

Power in Indonesia: Investment and Taxation Guide - 7th Edition

This guide has been written as a tailored investment, regulatory and taxation guide for all those interested in the power sector in Indonesia. We have therefore endeavoured to create a guide which can be of use to existing investors, potential investors, and others with an interest in the status of this economically critical sector for Indonesia.

This edition has been updated to reflect the regulations issued up to 1 July 2023, including a focus on ESG strategy and disclosure, energy transition and carbon pricing (including commercial, regulatory and taxation aspects of carbon trading).

Map of Indonesia's Major Power Plants and Transmission Lines - 2025

PwC Indonesia has released the 2025 update of its Map of Indonesia's Major Power Power Plants & Transmission Lines, providing the location of key existing and planned power plants and transmission lines in Indonesia.

Please fill the form here to obtain our latest Map of Indonesia's Major Power Plants and Transmission Lines.

May 2019

Global power strategies

In the past 30 years, electricity and gas markets around the world have been radically transformed as market forces play an increasing role in energy supply and distribution. Decarbonization, decentralization, and digitization are compelling utilities to evolve faster than ever before. How are they responding to this new, three-dimensional challenge?

December 2018

Forging the power and water markets of the future

Power and water market design varies significantly across the Middle East (ME), Africa and Asia. But policy-makers everywhere face the common challenge of ensuring outcomes are consistent with their policy targets and investment requirements. In many locations, water resources are stretched. And as power systems become more decentralised, the need to balance energy resilience with flexibility is adding a new tension to the central trilemma of reliability, affordability and sustainability.

November 2018

The narrowing window for energy transformation

PwC has released the findings of its 15th Global Power and Utilities Survey in November 2018. Between September and October 2018, we gathered the views of 118 power and utility company executives from over 100 companies and 56 different countries or territories in Europe, the Americas, Asia–Pacific, Middle East and Africa. The Europe region includes Russia.

Global energy transformation is gathering pace, driven by the twin forces of changing customer expectations and rapid technological evolution. In response, companies must undertake a strategic shift to prepare for new energy markets. Yet 82 percent of utility executives in our latest Global Power & Utilities Survey say their company is not yet ready for the transformation. In the meantime, new players from outside the sector are sizing up opportunities in energy markets around the world.

November 2018

Power in Indonesia: Investment and Taxation Guide - 6th Edition

This Guide has been written as a general investment and taxation guide for all stakeholders and those interested in the power sector in Indonesia. We have therefore endeavoured to create a Guide which can be of use to existing investors, potential investors, and others with an interest in the status of this economically critical sector for Indonesia.

This edition of the Guide has been updated to reflect the regulations issued in late 2017 to mid 2018 (which are notably fewer and less substantial than last year). However, in this edition we have placed a greater focus on the tracking of actual transactions and project implementation, particularly in light of the wave of Power Purchase Agreements (“PPAs”) signed last year.

We hope readers find our comments on these developments helpful but reinforce the interpretational uncertainty that exists around the regulatory environment in Indonesia.

July 2018

Alternating Currents: Indonesian Power Industry Survey 2018

PwC Indonesia has launched the second edition of the Power Industry Survey in association with the Independent Power Producers Association of Indonesia (“APLSI”) to better understand the current condition of the electric power industry in Indonesia, and the opportunities and challenges the future holds.

The survey covers Electricity planning; Investor confidence; Investor returns; Regulations; Energy policy and market design; and, many other trends and issues. This year, the survey identified a sharp deterioration in investor confidence given regulatory uncertainty around power tariffs and Power Purchase Agreement risk allocation. But, there is still intent to invest in the Indonesian power sector, and the survey highlights a number of potential solutions to further accelerate investment.

December 2017

Power in Indonesia: Investment and Taxation Guide 2017

The 5th edition of PwC Indonesia's popular “Power in Indonesia: Investment and Taxation Guide” has been updated extensively for the substantial volume of regulatory and policy developments in 2017. The Guide provides a comprehensive overview of the key commercial and taxation considerations for investors in the Indonesian power sector, and should be of interest to existing industry players, potential investors, and others with an interest in the status of this economically critical sector for the development of Indonesia.

We hope readers will find our updates on these developments beneficial and we welcome queries on investing in the Indonesian power sector.

May 2017

Powering the Nation: Indonesian Power Industry Survey 2017

PwC Indonesia cooperated with the Independent Power Producers Association of Indonesia (ALPSI) to prepare this report to better understand the current condition of the electric power industry in Indonesia, and the opportunities and challenges for the future.

In furtherance of the development of the country’s power industry, this report is also aimed at acknowledging the role of the private sector in supporting the growth and reliability of the Indonesian electric power sector. This is in line with the country’s agenda of achieving an electrification target of 99.7% by 2025, under which at least 80.5 GW of power plants need to be constructed.

November 2016

Power in Indonesia

Investment and Taxation Guide – 4th edition

A comprehensive guide to the Indonesian power sector for both existing and potential investors and others with a general interest in the status of this economically critical sector for the development of Indonesia. Expanded and updated from previous editions to include details of the Government’s plans and a discussion of the trends in the conventional and renewable energy sectors.

April 2016

Power in Indonesia

Re-printed edition of power industry's investment and taxation guide 2015

March 2016

Private Power Utilities: The Economic Benefit of Captive Power in Industrial Estates in Indonesia

GE Operations Indonesia (“GE”), in conjunction with PwC Indonesia, has produced a report on Private Power Utilities in Industrial Estates to understand their economic benefits.

2019

Chemical trends 2019

Just a short time ago, there was a notable dose of optimism evident in the chemicals sector. Having confronted extraordinary pressures for more than a decade—chiefly from product commoditisation, raw materials volatility, fluctuating markets and rapidly expanding competition—2018 initially delivered some strong results. Profits were up, capacity was tight and global demand was on a positive trajectory.

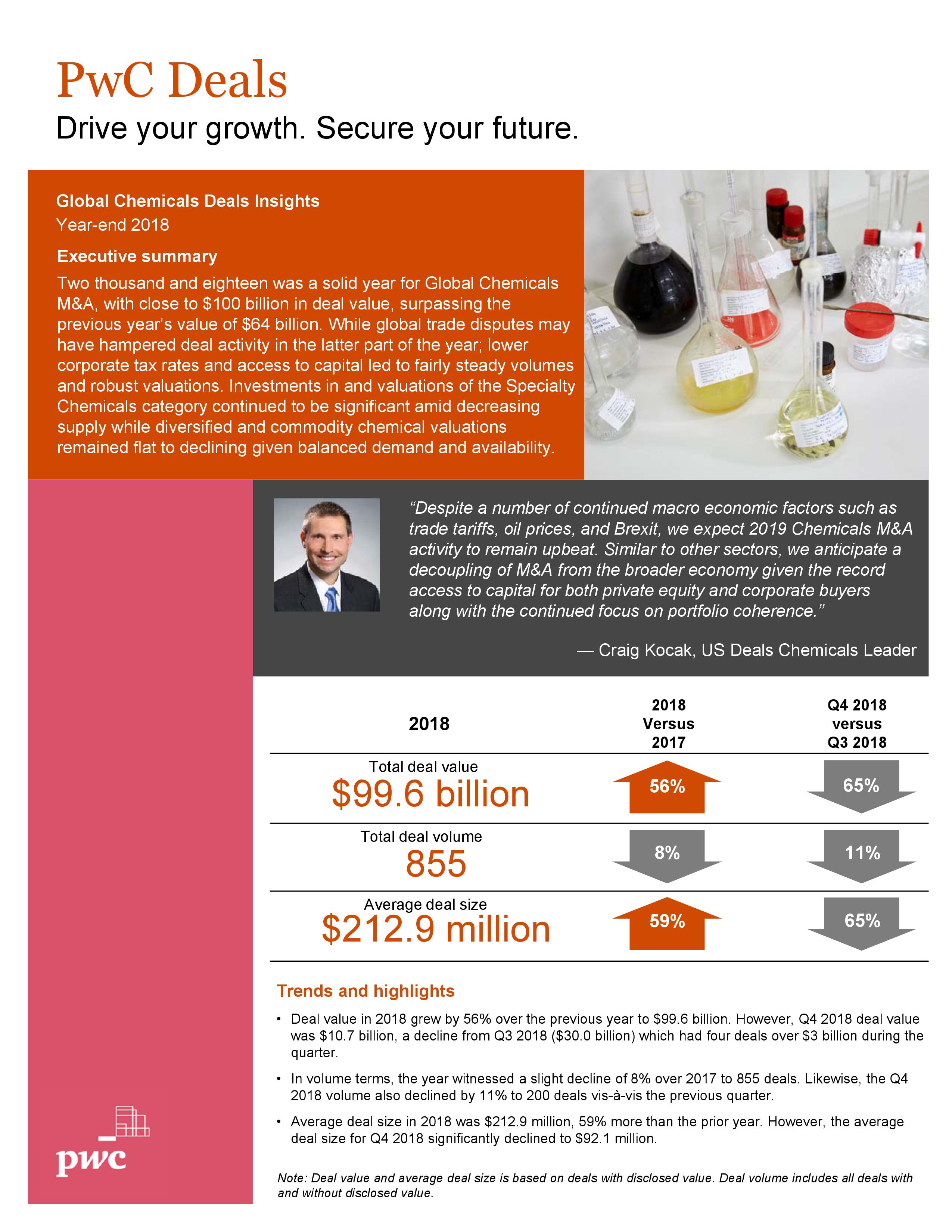

2019

Who are the high-leverage innovators in chemicals and energy?

Companies that consistently beat their peers on seven key financial metrics. And spend their R&D dollars more efficiently.

2019

Global Chemicals Deals Insights - Year-end 2018

Despite macro-economic factors such as trade tariffs, oil prices and Brexit, we expect chemicals M&A to remain upbeat.

2018

Chemicals Trends 2018-2019: A tipping point of profitability

Prodded by accelerating technology advances, which are shaping customer purchases and needs, some chemicals companies have begun to rethink their growth strategies, finally moving away from cost-cutting and retrenchment, toward more nimble, coherent, and aggressive business models. Timidity and contraction are giving way to new ways of navigating and benefitting from mergers and acquisitions, digital products and services, and even political forces affecting global trade. Although this trend is nascent, it is nonetheless significant and could place the chemicals industry on a path to improved performance in the short-term and offer better prospects for long-term growth.

Check out our NewsFlash

2023

- Energy, Utilities & Resources NewsFlash No.76/2023 - Special Edition - Responding to Climate Change and Creating Value through Implementing an ESG Strategy

- Energy, Utilities & Resources NewsFlash No.75/2023 - Special Edition – Navigating volatility, bringing transparency and improving businesses continually through business process excellence

- Energy, Utilities & Resources NewsFlash No.74/2023 - Regulation on Electricity Selling Price, Electricity Lease Network Price, and Electricity Tariff / An Update on Carbon Trading and Carbon Tax Mechanism for Independent Power Producers (“IPPs”)

- Energy, Utilities & Resources NewsFlash No.73/2023 - Recently Updated Tax Rules for the Coal Mining Sector / New Regulation on Coal Domestic Market Obligation / GR49-2022 – Update on VAT Status for Certain Mining Products / Decree on Expansion of Mining Areas / Right to Apply for Mining Business Licence upon the Existence of a State Administrative Court Decision

- Energy, Utilities & Resources NewsFlash No.72/2023 - Special Edition - Performance Evaluation for the Risk Management Desk

2020

- Energy, Utilities & Resources NewsFlash No.69/2020 - Omnibus Law/ PerMen ESDM 11/2020 – the Government’s Support for Domestic Nickel Mining Companies/ Update on Regulation for Gross Split PSCs/ Gross Split PSCs - Facilities re. VAT and Land & Building Tax

- Indonesia Energy, Utilities & Resources NewsFlash No.68/2020 - Amendment to the Mining Law – Providing some certainty in uncertain times

- Indonesia Energy, Utilities & Resources NewsFlash No. 67/2020 - Draft Omnibus Laws – Tax/ Renegotiated Indonesia – Singapore Tax Treaty/ Land and Building Tax Objects-New Minister of Finance Regulation/ Import Tax Facilities for PSC and Geothermal Sectors – An Update

2019

- Energy, Utilities & Resources NewsFlash No. 66/2019 - MOF-257 Refresh/ Clarity on BPT on PSC Transfer / New Permanent Establishment (“PE”) Rules / Extended VAT/Land and Building Tax Relief for PSCs / US Dollar Bookkeeping for Tax Purposes for Holders of Special Mining Business Licences in “Production Operation” (“IUPK-OP”) / New Regulation on VAT Reimbursement Procedures for PSCs / Mine 2019: Resourcing the future

- Energy, Utilities & Resources NewsFlash No. 65/2019 - Developments around Treaty Use/ Recent Indonesian Court/ Decisions on a Number of Key PSC Tax Issues/ Domestic Trading for Crude Oil – Tax treatment/ Latest Draft of Indonesia’s Planned Oil and Gas Law/ VAT Status of LNG/ VAT Collector obligations for certain mining companies/ Requirement to deposit Export Proceeds into an Indonesian FX Bank/ Income Tax treatment of Grants provided under the Viability Gap Fund (“VGF”)

2017

- Energy, Utilities & Mining NewsFlash No.62/2017 - The “new” GR 79 – major changes to the key PSC cost recovery and tax regulation

- Energy, Utilities & Mining NewsFlash No.61/2017 - Investing in Power: Risks under the new PPA and tariff regulations for renewables

- Energy, Utilities & Mining NewsFlash No. 60/2017 - Special Edition - Gross Split PSCs